Our Market Operations Weekly Report contains the latest information about the electricity market, including security of supply, wholesale price trends and system capacity.

It is published every Tuesday. Click here to receive the report via email every week.

If you have any comments or questions please contact the Market Operations Team at [email protected].

Latest Report / More Information

|

|

Current Storage Positions

Overview

New Zealand hydro storage has started to decline but remains above the 90th percentile at 117% of the historic mean. This is contributing to the consistent high levels of renewable generation in the mix since October.

This week’s insight takes a closer look at renewable generation performance in recent months and its influence on carbon emissions.

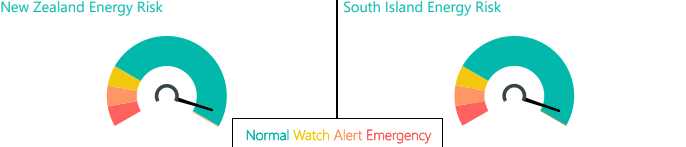

Security of Supply and Capacity

Energy

National hydro storage decreased from 122% to 117% of the historic mean. South Island hydro storage decreased from 119% to 113% of the historic mean, and North Island storage increased from 154% to 157%.

Capacity

Residuals were healthy with over 1000 MW of residual over all peaks last week. The lowest residual of 1343 MW occurred during the morning peak on Wednesday 28 January.

The N-1-G margins in the NZGB forecast are healthy through to the end of March. Within seven days we monitor these more closely through the market schedules. The latest NZGB report is available on the NZGB website.

Electricity Market Commentary

Weekly Demand

Total demand last week decreased to 700 GWh from 712 GWh the week before and was the lowest for this time of year since 2023. The highest demand peak of 4,945 MW occurred at 5:30 pm on Thursday 29 January.

Weekly Prices

The average wholesale electricity spot price at Ōtāhuhu last week was $2/MWh, slightly decreasing from $3/MWh the week prior. Wholesale prices peaked at $12/MWh at Ōtāhuhu at 9 pm on Thursday 29 January. There were several instances of price separation between the North and South islands throughout the week, when HVDC northward flow reached its maximum capacity.

Generation Mix

Total renewable contribution to the mix was 98% last week, the 17th consecutive week above 96%. This consisted of hydro generation which remained above its average at 61% of the generation mix. Wind generation was close to average at 8% of the mix, solar generation was 2% of the mix and the geothermal share was 27% of the mix, above its average contribution of 23%. Thermal generation was below 1% of the mix.

HVDC

HVDC flow was entirely northward last week with high hydro generation and higher demand in the North Island. In total, 70 GWh was transferred north.

Consultations

We have released our initial engagement paper as part of the development of a System Operator strategy. This outlines why a refreshed strategy is needed now and describes our approach to shaping the future of system operations. Responses are due by Friday 27 February.